Презентация Global economy (economics)(ge) and World Economic Relations (WER) онлайн

На нашем сайте вы можете скачать и просмотреть онлайн доклад-презентацию на тему Global economy (economics)(ge) and World Economic Relations (WER) абсолютно бесплатно. Урок-презентация на эту тему содержит всего 95 слайдов. Все материалы созданы в программе PowerPoint и имеют формат ppt или же pptx. Материалы и темы для презентаций взяты из открытых источников и загружены их авторами, за качество и достоверность информации в них администрация сайта не отвечает, все права принадлежат их создателям. Если вы нашли то, что искали, отблагодарите авторов - поделитесь ссылкой в социальных сетях, а наш сайт добавьте в закладки.

Презентации » Экономика и Финансы » Global economy (economics)(ge) and World Economic Relations (WER)

Оцените!

Оцените презентацию от 1 до 5 баллов!

- Тип файла:ppt / pptx (powerpoint)

- Всего слайдов:95 слайдов

- Для класса:1,2,3,4,5,6,7,8,9,10,11

- Размер файла:1.35 MB

- Просмотров:150

- Скачиваний:0

- Автор:неизвестен

Слайды и текст к этой презентации:

№2 слайд

Содержание слайда: CONTENT:

1. General definitions and terms of GE.

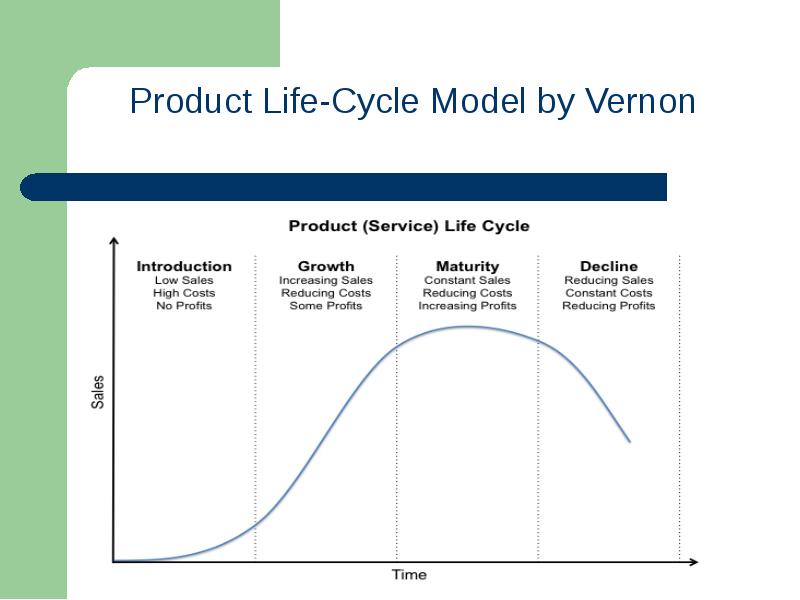

2. Theories of the world trade (WT).

3. WT regulation. Free trading and protectionism. INCOTERMS 2010.

4. Economic integration.

5. Currency. International monetary system.

6. Transnational companies.

7. Balance of payments.

8. Offshores.

№4 слайд

Содержание слайда: The difference between similar terms:

economic/economical

Economic pertains to the economy.

Economical means not wasteful.

economy/economics

The economy is the relationship between production, trade and the supply of money in a particular country or region (The economy is in recession).

Economics is a science that studies economies and develops possible models for their functioning (He studied economics at the LSE (London School of Economics).

№5 слайд

Содержание слайда: The world economy or global economy is the economy of the world, considered as the international exchange of goods and services that is expressed in monetary units of account (money).

In some contexts, the two terms are distinguished: the "international" or "global economy" being measured separately and distinguished from national economies while the "world economy" is simply an aggregate of the separate countries' measurements.

№6 слайд

Содержание слайда: A subject matter of GE is WER.

A subject matter of GE is WER.

WER:

trade of goods and services;

capital flow;

labour migration;

intellectual property trade;

currency relations;

credit relations (World Bank, International Monetary Fund );

co-operation of production (multinational companies/transnational corporations).

№9 слайд

Содержание слайда: GENERAL MEANING OF THE TERM «GE»:

a system of world economic relations, national economies` cooperation;

A combination of different economic sectors and branches of national economies;

national economies` unity and world economic relations that help to make a complete and stable system.

№16 слайд

Содержание слайда: Basics of Heckscher Ohlin theory:

2 countries

2 items of goods – cloth and food

2 resources – Labour and Land (to produce the items) (you can also take Capital instead, but you should change an item of goods – cars for example)

2 production possibility curves (combination of 2 goods` max production with full usage of production factors in a country)

2 indifference curves (geometrical combination of 2 goods with equal utility)

There are also some assumptions

№17 слайд

Содержание слайда: The H-O theory says that countries will export products that use their abundant and cheap factor and import products that use countries` scarce factor.

The H-O theory says that countries will export products that use their abundant and cheap factor and import products that use countries` scarce factor.

№23 слайд

Содержание слайда: What`s the difference between tradable and non-tradable goods:

A price for TG is defined by a ratio between demand & supply;

A balance of D&S for NTG is more important for there`s no opportunity to substitute them with foreign goods;

Local (domestic) prices for TG and their change (rise & fall) usually depends on foreign one.

№26 слайд

Содержание слайда: Eurasian Economic Union

is an economic union of states located primarily in northern Eurasia.

The Treaty aiming for the establishment of the EAEU was signed on 29 May 2014 by the leaders of Belarus, Kazakhstan and Russia, and came into force on 1 January 2015.

Treaties aiming for Armenia's and Kyrgyzstan's accession to the Eurasian Economic Union were signed on 9 October and 23 December 2014, respectively.

№31 слайд

Содержание слайда: How сan customs value be estimated (calculated, defined, assessed)?

The methods of customs valuation, in descending order of precedence, are:

Transaction Value (TV)* of Imported Merchandise

Transaction Value of Identical Merchandise (goods, commodities) – 90 days

Transaction Value of Similar Merchandise – 90 days

Deductive Value

Computed Value

Derivative Method

* TV is the price actually paid or payable for the goods when sold for export to the country of importation

№33 слайд

Содержание слайда: Computed Value:

Computed Value:

Goods estimated (calculated) value

=

Operating (production) cost (expenditure) – all we need to produce smth – materials, energy, labour, depreciation etc.

+

2. Move & insurance costs

+

3. Packaging costs

+

3. Selling and administration costs

+

4. Agent commission

№34 слайд

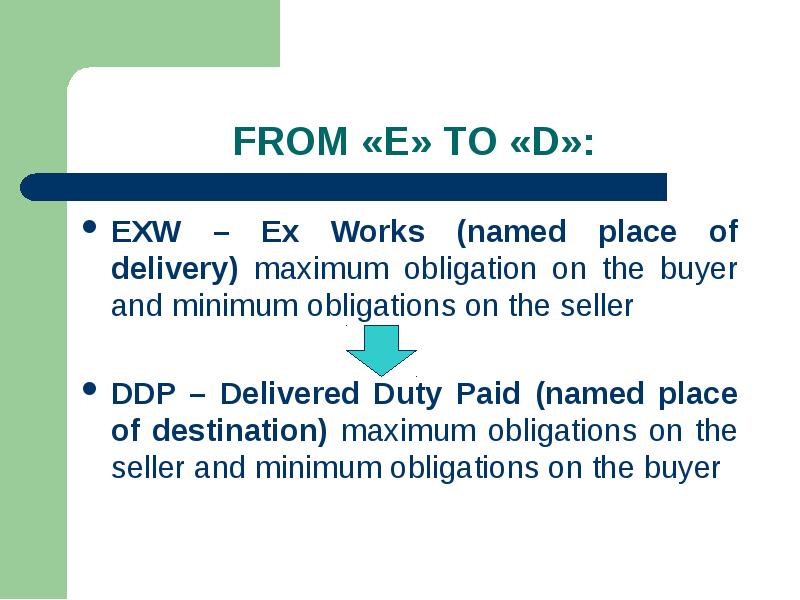

Содержание слайда: Defined terms in Incoterms:

(International Commercial Terms)

- define obligations, costs, and risks involved in the delivery of goods from the seller to the buyer

- don’t define price payable, currency or credit items

Delivery: The point in the transaction where the risk of loss or damage to the goods is transferred from the seller to the buyer

Arrival: The point named in the Incoterm to which carriage has been paid

Free: Seller has an obligation to deliver the goods to a named place for transfer to a carrier

Carrier: Any person who, in a contract of carriage, undertakes to perform or to procure the performance of transport by rail, road, air, sea, inland waterway or by a combination of such modes

Freight forwarder: A firm that makes or assists in the making of shipping arrangements;

Terminal: Any place, whether covered or not, such as a dock, warehouse, container yard or road, rail or air cargo terminal

To clear for export: To file Shipper’s Export Declaration and get export permit

№36 слайд

Содержание слайда: The Economic Integration between two countries is a measure of how much two or more countries work together, or give preference to each other.

The Economic Integration between two countries is a measure of how much two or more countries work together, or give preference to each other.

Micro-aproach: MNC (TNC)

Macro-aproach: interstate organizations and integration associations

№38 слайд

Содержание слайда: Economic integration:

is the unification of economic policies between different states;

the partial or full abolition of tariff and non-tariff restrictions;

lower prices for distributors and consumers with the goal of increasing the level of welfare

Economic integration is an economic arrangement between different regions, marked by the reduction or elimination of trade barriers and the coordination of monetary and fiscal policies. The aim of economic integration is to reduce costs for both consumers and producers, and to increase trade between the countries taking part in the agreement.

The more integrated the economies become, the fewer trade barriers exist, and the more economic and political coordination there is between the member countries.

№39 слайд

Содержание слайда: What is the basis of economic integration?

Comparative advantage refers to the ability of a person or a country to produce a particular good or service at a lower marginal and opportunity (alternative) cost over another.

Economies of scale refers to the cost advantages that an enterprise obtains due to expansion. There are factors that cause a producer’s average cost per unit to fall as the scale of output is increased. Economies of scale is a long run concept and refers to reductions in unit cost as the size of a facility and the usage levels of other inputs increase.

№40 слайд

Содержание слайда: Degrees of economic integration:

Preferential trading area

Free trade area (North American Free Trade Agreement)

Customs union

Common market can be united into one degree

Economic union

Economic and monetary union

Complete economic integration

These differ in the degree of unification of economic policies, with the highest one being the completed economic integration of the states, which would most likely involve political integration as well.

№41 слайд

Содержание слайда: Additional info about degrees:

A "free trade area" (FTA) is formed when at least two states partially or fully abolish custom tariffs on their inner border. To exclude regional exploitation of zero tariffs within the FTA there is a rule of certificate of origin for the goods originating from the territory of a member state of an FTA.

A "customs union" introduces unified tariffs on the exterior borders of the union (CET, common external tariffs).

A "monetary union" introduces a shared currency.

A "common market" add to a FTA the free movement of services, capital and labor.

An "economic union" combines customs union with a common market. A "fiscal union" introduces a shared fiscal and budgetary policy. In order to be successful the more advanced integration steps are typically accompanied by unification of economic policies (tax, social welfare benefits, etc.), reductions in the rest of the trade barriers, introduction of supranational bodies, and gradual moves towards the final stage, a "political union".

№42 слайд

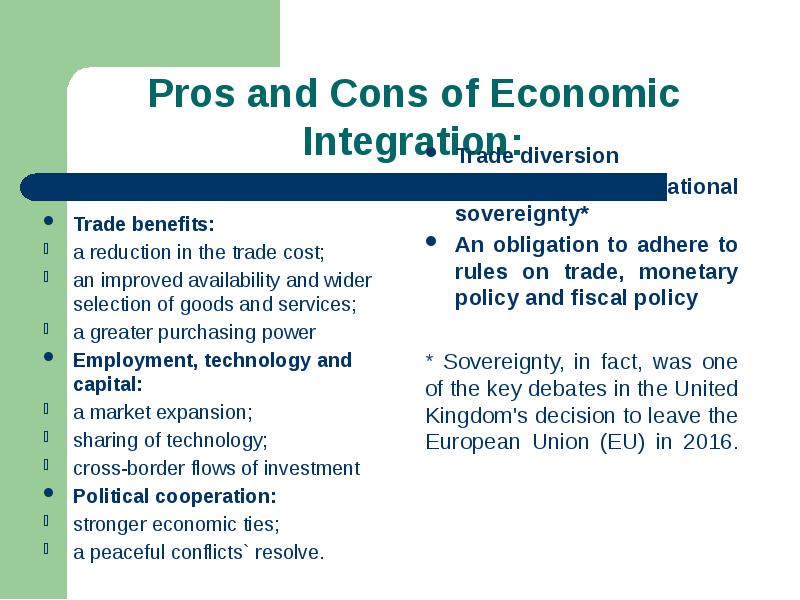

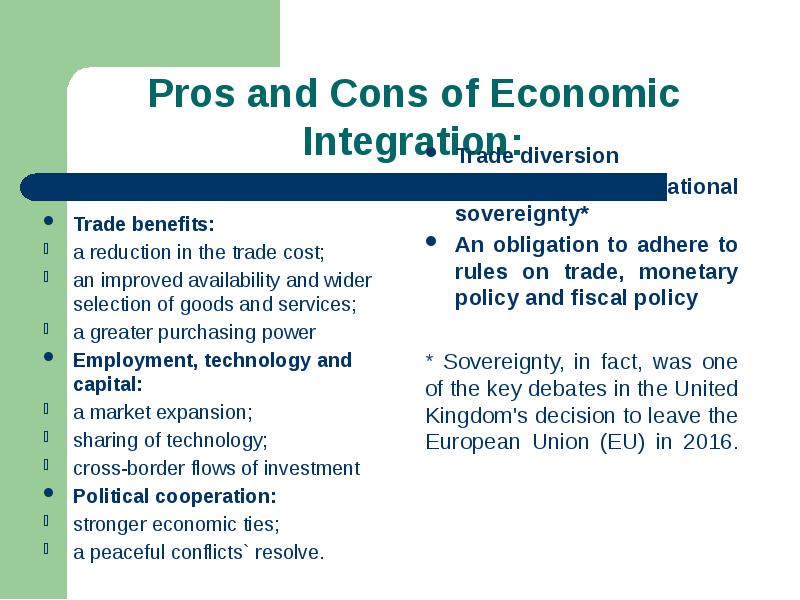

Содержание слайда: Pros and Cons of Economic Integration:

Trade benefits:

a reduction in the trade cost;

an improved availability and wider selection of goods and services;

a greater purchasing power

Employment, technology and capital:

a market expansion;

sharing of technology;

cross-border flows of investment

Political cooperation:

stronger economic ties;

a peaceful conflicts` resolve.

№43 слайд

Содержание слайда: Measuring Economic Integration

The methodology for measuring economic integration typically involves the combination of multiple economic indicators, including:

1. trade in goods and services,

2. cross-border capital flows,

3. labor migration and others.

It also includes measures of institutional conformity, such as membership in trade unions and the strength of institutions that protect consumer and investor rights. A standardized ranking of European Union countries shows that Finland, Austria, Spain and France are the most integrated into the EU.

№45 слайд

Содержание слайда: Currency refers to a particular authorized monetary system, monetized in specific units (euros, dollars, pesos, etc.) which may be given international value by their exchange values in foreign exchange.

Currency refers to a particular authorized monetary system, monetized in specific units (euros, dollars, pesos, etc.) which may be given international value by their exchange values in foreign exchange.

№46 слайд

Содержание слайда: Each currency typically has a main currency unit (the dollar, for example, or the euro) and a fractional unit, often defined as 1⁄100 of the main unit: 100 cents = 1 dollar, 100 centimes = 1 franc, 100 pence = 1 pound, although units of 1⁄10 or 1⁄1000 occasionally also occur. Some currencies do not have any smaller units at all, such as the Icelandic króna.

Each currency typically has a main currency unit (the dollar, for example, or the euro) and a fractional unit, often defined as 1⁄100 of the main unit: 100 cents = 1 dollar, 100 centimes = 1 franc, 100 pence = 1 pound, although units of 1⁄10 or 1⁄1000 occasionally also occur. Some currencies do not have any smaller units at all, such as the Icelandic króna.

№47 слайд

Содержание слайда: Convertibility of a currency determines the ability of an individual, corporate or government to convert its local currency to another currency or vice versa with or without central bank/government intervention.

Based on the above restrictions or free and readily conversion features, currencies are classified as:

Fully convertible When there are no restrictions or limitations on the amount of currency that can be traded on the international market, and the government does not artificially impose a fixed value or minimum value on the currency in international trade. The US dollar is an example of a fully convertible currency and, for this reason, US dollars are one of the major currencies traded in the foreign exchange market.

№48 слайд

Содержание слайда: Partially convertible Central banks control international investments flowing in and out of the country, while most domestic trade transactions are handled without any special requirements, there are significant restrictions on international investing and special approval is often required in order to convert into other currencies. The Indian rupee and Renminbi are examples of a partially convertible currency.

Partially convertible Central banks control international investments flowing in and out of the country, while most domestic trade transactions are handled without any special requirements, there are significant restrictions on international investing and special approval is often required in order to convert into other currencies. The Indian rupee and Renminbi are examples of a partially convertible currency.

Nonconvertible Neither participate in the international FOREX market nor allow conversion of these currencies by individuals or companies. As a result, these currencies are known as blocked currencies. e.g.: North Korean won and the Cuban peso.

№51 слайд

Содержание слайда: Lets find the cross-rate for the Russian ruble:

The C-R is an exchange rate between two currencies, in which the home country's currency is not included. In the U.S.A., the euro/yen rate would be considered a cross rate, while in Europe or Japan it would be considered a primary pair.

For the Russian Federation:

1 EUR = 68.98 RUB

1 USD = 59.28 RUB

So the C-R for EUR/USD is 1,1636.

№52 слайд

Содержание слайда: An exchange-rate regime (ERR)

is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.

There are 3 basic types of ERR:

a floating exchange rate, where the economy dictates movements in the exchange rate;

a pegged float, where a central bank keeps the rate from deviating too far from a target band or value;

a fixed exchange rate, which ties the currency to another currency, mostly reserve currencies such as the U.S. dollar or the euro or a basket of currencies.

№53 слайд

Содержание слайда: Floating rates are the most common exchange rate regime today. For example, the dollar, euro, yen, and British pound all are floating currencies.

Floating rates are the most common exchange rate regime today. For example, the dollar, euro, yen, and British pound all are floating currencies.

However, since central banks frequently intervene to avoid excessive appreciation or depreciation, these regimes are often called managed float or a dirty float.

Managed float regime is the current international financial environment in which exchange rates fluctuate from day to day, but central banks attempt to influence their countries' exchange rates by buying and selling currencies. It is also known as a dirty float.

№54 слайд

Содержание слайда: Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted. During the 1950s and most of the 1960s, for example, the United States pegged the dollar to gold ($35.00 was equal to one ounce of gold), and most other countries had pegged their currencies to the dollar (the German Mark was fixed at four marks equal to one dollar for much of this time).

Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted. During the 1950s and most of the 1960s, for example, the United States pegged the dollar to gold ($35.00 was equal to one ounce of gold), and most other countries had pegged their currencies to the dollar (the German Mark was fixed at four marks equal to one dollar for much of this time).

The band of fluctuation is the range within which the market value of a national currency is permitted to fluctuate by international agreements, or by unilateral decision by the central bank.

№58 слайд

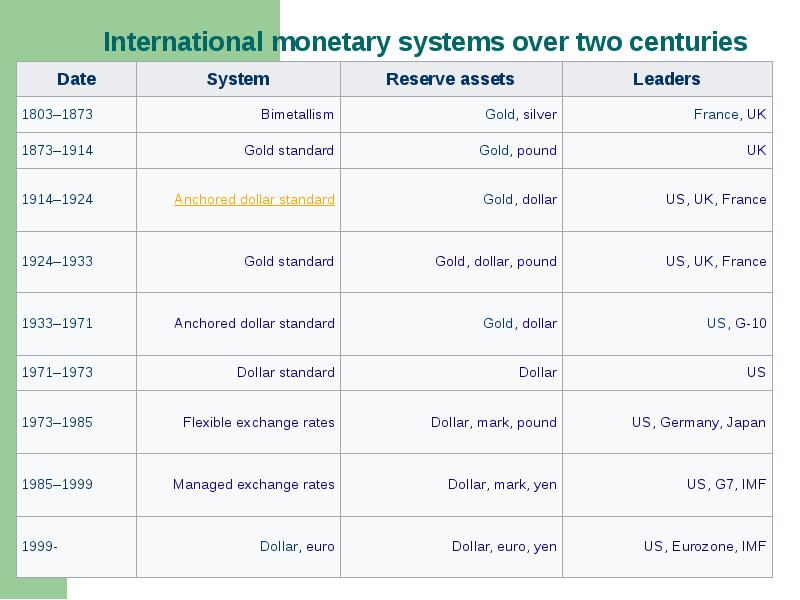

Содержание слайда: International monetary systems (IMS)

International monetary systems are sets of internationally agreed rules and supporting institutions, that facilitate international trade, cross border investment* and generally the reallocation of capital between nations.

* is an investment in the form of a controlling ownership in a business in one country by an entity based in another country.

№62 слайд

Содержание слайда: By the way, what`s about the Russian ruble?

As for the ruble, in spite of high oil prices it`s under pressure:

Low demand for federal (loan) bonds

High demand for the foreign currency both by Russian corporations and the RF` Ministry of Finance.

All the rent income is spent on buying currency in order to increase the foreign exchange reserves.

3. Geopolitics

№65 слайд

Содержание слайда: The United Nations has justly described TNC as “the productive core of the globalizing world economy.”

Their 270,000 foreign affiliates account for most of the world's industrial capacity, technological knowledge, international financial transactions, and ultimately the power of control.

1. In terms of energy, they mine, refine and distribute most of the world’s oil, gasoline, diesel and jet fuel, as well as build most of the world’s oil, coal, gas, hydroelectric and nuclear power plants.

2. They extract most of the world’s minerals from the ground.

3. They manufacture and sell most of the world’s automobiles, airplanes, communications satellites, computers, home electronics, chemicals, medicines and biotechnology products.

4. They harvest much of the world’s wood and make most of its paper.

5. They grow many of the world’s major agricultural crops, while processing and distributing much of its food.

№66 слайд

Содержание слайда: Sustainable Development Goals (SDGs) and TNCs

The globalization of economic activity in general, and the growing role of transnational corporations (TNCs) in particular, have increasingly directed attention toward the environmental consequences of these developments. That is to say given their dominance of politics, economics and technology, it is not surprising to find the big transnationals deeply involved in most of the world’s serious environmental crises

Emerging-market multinational enterprises (EMNEs) play an increasingly important role as investors in developing economies. When certain conditions are met, their foreign investment can contribute to host-country progress towards the Sustainable Development Goals (SDGs).

№67 слайд

Содержание слайда: The Sustainable Development Goals (SDGs).

Goal 1: No Poverty

Goal 2: Zero Hunger

Goal 3: Good Health and Well-Being

Goal 4: Quality Education

Goal 5: Gender Equality

Goal 6: Clean Water and Sanitation

Goal 7: Affordable and Clean Energy

Goal 8: Decent Work and Economic Growth

Goal 9: Industry, Innovation and Infrastructure

№68 слайд

Содержание слайда: What are the functions of TNC?

Importing and exporting goods and services

Making significant investments in a foreign country

Buying and selling licenses in foreign markets

Engaging in contract manufacturing—permitting a local manufacturer in a foreign country to produce their products

Opening manufacturing facilities or assembly operations in foreign countries

№69 слайд

Содержание слайда: The 5 Cons of Multinational Corporations.

1. The Market Dominance of Multinational Corporations - The market dominance of multinational corporations makes it hard for the local small firms to succeed and thrive. For instance, there are arguments stating that the larger supermarkets squeeze out a notable margin of the local corner stores that lead to lesser diversity.

2. Consumer’s Expenses - Companies are usually interested at the consumer’s expense. The multinational companies commonly have the power of monopoly that gives them the chance of making excess profit.

3. Pushing Local Firms Out Of Business - In the developing economies, these giant multinationals use the economies of scale for pushing the local firms out of their businesses.

4. Criticized For Using "Slave Labor" - Multinational corporations are being criticized for using the so-called slave labor wherein the workers are paid with very small wages.

5. Environment Threat - For the sake of profit, these global companies commonly contribute to pollution as well as make use of the non-renewable resources that can be a threat to the environment.

№73 слайд

Содержание слайда: What is «a balance of payments»?

It`s a doc which summarizes an economy’s transactions with the rest of the world for a specified time period.

The balance of payments, also known as balance of international payments, encompasses (covers) all transactions between a country’s residents and its nonresidents involving goods, services and income; financial claims on and liabilities to the rest of the world; and transfers such as gifts.

№75 слайд

Содержание слайда: СТРУКТУРА ПБ

1. Счёт текущих операций

A. Торговый баланс

B. Баланс услуг

C. Текущие трансферты и доходы, в том числе, от инвестиций

2. Счёт операций с капиталом и финансовыми инструментами

A. Счёт операций с капиталом (капитальные трансферты)

B. Финансовый счёт:

Прямые инвестиции

Портфельные инвестиции

Ссуды и займы

3. Чистые пропуски и ошибки

4. Изменение официальных резервов (резервных активов)

№76 слайд

Содержание слайда: ОТТОК/ ПРИТОК

Положительное сальдо счёта движения капитала определяется как чистый приток капитала в страну.

Наоборот, чистый отток (или вывоз капитала) возникает на фоне дефицита счёта движения капитала, когда расходы на покупки активов за границей превосходят доходы от их продажи за рубеж.

№78 слайд

Содержание слайда: Economic policies are often targeted at specific objectives that, in turn, impact the balance of payments.

For example, a country may adopt policies specifically designed to attract foreign investment in a particular sector.

Another nation may attempt to keep its currency at an artificially depressed level to stimulate exports and build up its currency reserves.

The impact of these policies is ultimately captured in the balance of payments data.

№80 слайд

Содержание слайда: МВФ рекомендует оценивать и экспорт и импорт единообразно — по цене на границе экспортирующей экономики.

Таким образом, для оценки и экспорта, и импорта следует использовать цены FOB.

Часто на практике данные об импортных поставках известны в ценах CIF (Cost, Insurance and Freight) и вводится соответствующая поправка. Эта поправка для таких стран, как США, Германия, Франция составляет от 5 до 7 % объёма импорта в ценах FOB.

№82 слайд

Содержание слайда: Does the B.O.P actually balance?

In theory, a current account deficit would have to be financed by a net inflow in the capital and financial account.

While a current account surplus should correspond to an outflow in the capital and financial account for a net figure of zero.

In actual practice, however, the fact is:

data compiled from multiple sources give(s) rise to some degree of measurement error.

№83 слайд

Содержание слайда: Дефицит счёта текущих операций платёжного баланса может быть профинансирован:

путём продажи части активов иностранцам, то есть за счёт вложения иностранного капитала в экономику данной страны в форме прямых или портфельных инвестиций;

с помощью зарубежных займов у иностранных банков, правительств или международных организаций;

за счёт сокращения официальных валютных резервов, хранящихся в Центральном банке.

№85 слайд

Содержание слайда: An offshore financial center (OFC)

It is a small, low-tax jurisdiction specializing in providing corporate and commercial services to non-resident offshore companies, and for the investment of offshore funds*.

Although information is still limited, there is strong evidence that OFCs captured a significant amount of global financial flows and functions both as back doors and partners of leading financial center.

* An offshore fund is a term which generally refers to a collective investment scheme domiciled in an offshore jurisdiction. Like the term "offshore company", the term is more descriptive than definitive, and both the words 'offshore' and 'fund' may be construed differently.

№86 слайд

Содержание слайда: Proponents VS Opponents

Proponents suggest that reputable offshore financial centers play a legitimate and integral role in international finance and trade, and that their zero-tax structure allows financial planning and risk management and makes possible some of the cross-border vehicles necessary for global trade.

Opponents view OFCs as draining tax revenues away from developed countries by allowing tax arbitrage, and rendering capital flows into and out of developing countries opaque.

№87 слайд

Содержание слайда: Confidentiality: I`ve never heard before…..

Statutory banking secrecy is a feature of several financial centers, notably Switzerland and Singapore.

However, many offshore financial centers have no such statutory right. Jurisdictions including Aruba, the Bahamas, Bermuda, the British Virgin Islands, the Cayman Islands, Jersey, Guernsey, the Isle of Man and the Netherlands Antilles have signed tax information exchange agreements, which commits them to sharing financial information about foreign residents suspected of evading home-country tax.

№88 слайд

Содержание слайда: Сколько денег хранится в офшорах, кто их там прячет и почему?

Получить ответы на эти вопросы чрезвычайно важно, так как это поможет в изучении неравенства, экономического развития и политики, отмечают исследователи Национального бюро экономических исследований (НБЭИ).

«Поправка на офшорные капиталы» позволяет оценить, какой на самом деле разрыв между богатыми и бедными в каждой стране.

Но считать деньги состоятельных людей становится сложнее. С одной стороны, увеличивается число стран, согласившихся на автоматический обмен финансовой информацией. Сейчас в таком списке уже 115 стран (они опубликованы на сайте Организации экономического сотрудничества и развития). В их числе популярные офшорные юрисдикции, такие как Панама и Каймановы острова.

С другой стороны, офшоры, предлагающие широкий спектр финансовых услуг, к примеру, легально сократить налоговые выплаты и облегчить ведение бизнеса, также помогают скрыть капиталы от посторонних глаз. И часть клиентов офшоров — пусть и небольшая — использует офшорные юрисдикции для сокрытия нечестно полученных доходов, пишут эксперты НБЭИ.

№90 слайд

Содержание слайда: Головная боль … офшоры

В абсолютных значениях объемы средств в офшорах растут: с 6 трлн долларов в 2005 году до 10 трлн долларов в 2016 году, Это данные Boston Consulting Group, полученные в ходе интервью со специалистами по управлению частными активами. По консервативным оценкам, в офшорах спрятано 10−13% мирового ВВП, считают в Boston Consulting Group.

А некоммерческая организация Tax Justice Network подсчитала не только финансовые активы, но и различные ценности, записанные на офшоры: яхты, предметы искусства, недвижимость. По данным Tax Justice Network, только в 2010 году в офшорах хранилось 21−32 трлн долларов.

№95 слайд

Содержание слайда: Резюме.

Меньше всего услугами налоговых гаваней пользуются скандинавские страны. К примеру, в скандинавских странах лишь 10,5% состояния 0,1% богатейших жителей хранится в офшорах.

Для России показатели другие: более 45% средств 0,1% самых богатых граждан находится в офшорах. Похожая ситуация наблюдается в странах Персидского залива и некоторых латиноамериканских государствах, таких как Венесуэла.

Скачать все slide презентации Global economy (economics)(ge) and World Economic Relations (WER) одним архивом:

Похожие презентации

-

Global economy and World Economic Relations (WER)

Global economy and World Economic Relations (WER) -

Global economy and world economic relations

Global economy and world economic relations -

Globalization and its Representation in the World Economy

Globalization and its Representation in the World Economy -

Economic globalisation. Pros and cons

Economic globalisation. Pros and cons -

United States and Japan. Security and Economic Relations

United States and Japan. Security and Economic Relations -

Global economy and Global economic Governance Intro

Global economy and Global economic Governance Intro -

The development of economic relations between China and Kyrgyzstan. Сurrent status and controversies

The development of economic relations between China and Kyrgyzstan. Сurrent status and controversies -

Economic and Consumer Behavior

Economic and Consumer Behavior -

The Long and Short of Macroeconomics

The Long and Short of Macroeconomics -

Economic systems a set of rules made by a country that governs the production and distribution of goods and services

Economic systems a set of rules made by a country that governs the production and distribution of goods and services